Goods and Services Tax or GST is made simple compared to earlier indirect tax laws. Comment by Guru murthyWe, a small company need some clarity on GST issue when invoicing our clients.

But under GST, he will be able to claim credit for tax paid on new refrigerator when he files his own taxes. Similarly, credit could be claimed on tax paid on taking business associates out for lunch, or on goods or service used for corporate social responsibility. Jan 7, 2019 - Input Tax Credits (ITCs) are the sum of the GST/HST you paid on legitimate business expenses or the allowable portion of the GST/HST paid.

We have taken some Interior designing project for a client; billed them the amount as per the estimate. Now our Out of Pocket expenses incurred on the project work are given to client separately (separate from the project invoice) with exact bills and we are billing exact amount, no overages for administration etc. On some bills such as food GST was charged, one or two minor bills the vendor themselves doesn’t have GST such as a small car owner whose car we used. Anyway point of all this background stuff, is to ask that say the OPE bill is a certain amount, we have bills to prove, and we are charging that exact amount to the client. Do we add 18% GST on the OPE bill?Our accountant has said we must charge GST, our client says we must not charge tax.

Is Gst Paid An Expense

What do we do? Also can you tell me the GST law, the provision so I can quote it, as needed to our client? Thanks a lot.

Comment by Janice PearlI have a few queries that I need help on:We are a company providing professional services to companies in Training and delivery of workshops at their venue. All persons who execute services work on a contract with XYZ Pvt. Does that make them a 'pure agent'?While executing services, there are expenses for conveyance, food, transportation, goods/material purchased on behalf of the client/customer. We pay for this (including GST) to the vendor and then claim reimbursement XYZ Pvt. Company we have a contract with along with raising invoices to them for professional fees. Currently, we are being asked to raise GST over both, invoice as well as debit note (reimbursements).

Is that accurate?

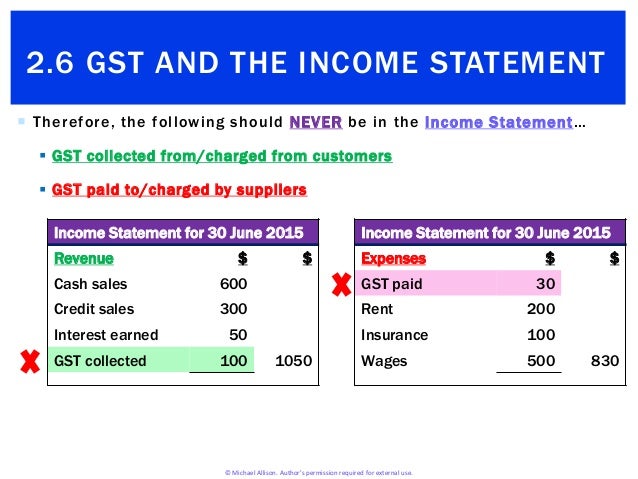

Accruals are mainly made for expenses that the company knows about but invoices from suppliers not yet received, like utilities accruals (company receives bill on May 1 for the utilities used in the month of April, so company will accrue the utilities cost based on estimate in April, as it has not known the actual bill during April closing).Accrued expenses are estimates, actual bill is not yet received, and no exchange of cash when expenses accrued; hence, should accrue expenses be inclusive of GST? If accrued expenses were to inclusive of GST, will it over or under state the GST at the point of accrual?If accrued expenses were to exclude the GST, then the double entry for the journal will be debit expense account and credit accrued expense account (current liability account).When bill received, you will charge it to the expense account with the GST associated.

Then, pass a journal to debit the accrued expenses and credit the expense account. If there is any differences in the expense account will be treated as current month expenses since the previous month had already been closed.